Double Plus: The Deferred Money Cycle Begins Again

Depending on how you look at it, the D-backs will only pay substantially over the major league minimum for sixteen players in 2016. One of them is Bernard Gilkey — and his is not even the lowest figure. The way things stand, the D-backs payroll is not very top heavy, despite the large commitment to Zack Greinke; the second-highest commitment is to Yasmany Tomas ($7.5M), and the portion of Aaron Hill‘s contract to be paid by the team still comes in second ($6.5). It’s a much longer way down from Greinke to Tomas than it is from Tomas to the sixteenth over-minimum salary, the $675,000 arbitration salary with Matt Reynolds. In the context of paying Gilkey nearly $1M, even that Reynolds salary looks comically low.

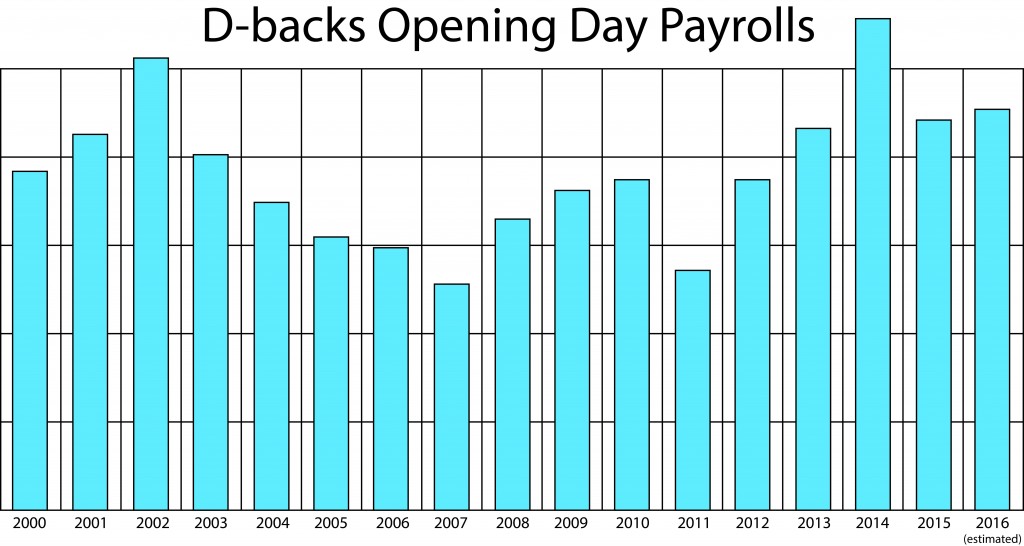

With the new television deal kicking in this season and recently shedding about $4M by trading Hill, there may be some financial room to maneuver at the moment; with the addition of about twelve major league minimum salaries to fill out an Opening Day roster, the D-backs might start with a payroll of about $91M this season. That’s slightly up from last year, but well down from the 2013 Opening Day payroll of $112.3M, and quite a bit shy of the post-World Series year in 2002 ($102.8M). Not a whole lot has changed, it seems. From Cot’s Contracts (data stretching back to 2000 only, sadly):

Thanks in part to shedding some salaries, the total financial commitments on the 40-man as of the end of the season ranked the D-backs just 28th among 30 teams. The revenue from the new television deal begins now, and while it’s staged incrementally (and I don’t know this year’s exact figure), there’s a big jump from the $30M a year to the $80M or so that will now come in on a yearly basis. That’s a huge difference, but as Jeff predicted almost a year ago, they haven’t exactly opened up the checkbook immediately, adopting a more measured approach. Still, the D-backs flexed their muscles in a big way in December by signing Greinke — and knowing that the new Greinke commitment only really brought them back to their own new baseline, maybe that shouldn’t have been unexpected.

Thanks in part to shedding some salaries, the total financial commitments on the 40-man as of the end of the season ranked the D-backs just 28th among 30 teams. The revenue from the new television deal begins now, and while it’s staged incrementally (and I don’t know this year’s exact figure), there’s a big jump from the $30M a year to the $80M or so that will now come in on a yearly basis. That’s a huge difference, but as Jeff predicted almost a year ago, they haven’t exactly opened up the checkbook immediately, adopting a more measured approach. Still, the D-backs flexed their muscles in a big way in December by signing Greinke — and knowing that the new Greinke commitment only really brought them back to their own new baseline, maybe that shouldn’t have been unexpected.

Greinke won’t actually make $34M in each of the six years in his contract, of course; he’ll actually make $24M per year through the final season on the contract, 2022 [correction: had previously said $21M per year here; thanks to Larry in comments] — and then he’ll start receiving yearly payments of $12.5M every November, starting in 2022 (a hefty bill in 2022, in particular). That’s the power of deferred money in contracts, something the D-backs franchise is very familiar with, and something that has become in vogue again in baseball. The Chris Davis contract, hammered out between Scott Boras and the Orioles? Peter Angelos might have negotiated that himself, but he’ll be 108 years old when Davis cashes his last check in 2037.

It was deferred money that fueled the fire in Arizona approaching (and after) the 2001 title run. I don’t have a total for you, but put it this way: we know the D-backs were still paying $16M in 2009, $15M in 2010, $14M in 2011, and $13M in 2012, at which point the deferred money was due for a big dropoff (think: ten-twelve years later). It seems that Gilkey is the last scion of the old pay-to-jumpstart model that helped the D-backs afford a title team. In other words, the D-backs aren’t just experiencing a revenue boost right now; they’re also finally free of significant deferred payments.

Greinke’s deferred money could be just the start. Ken Kendrick’s ownership group bought the team in March 2004, apparently inheriting a decade of deferred payments — which appear to have helped to keep the D-backs payroll under $80M from 2004 all the way to 2013. Kendrick waited a decade while paying for the past, and once that red ink was taken off the balance sheet, you can’t really blame him for going for it. He also has that experience of knowing just how much a title run can affect a franchise’s prices.

Think about it. We’ve just watched the Yoan Lopez signing cut off the team’s ability to sign international amateurs for more than $300k for two years (through July 2017), the Jeremy Hellickson deal, the Toussaint sale, the Miller trade, and more recently an Isan Diaz going away party. Acting like the future matters little is entirely consistent with the heavily deferred Greinke contract. So you’re hearing it here: the next year or so could see a lot more deferred money added to the D-backs’ future commitments, through signing of 2016-2017 free agents, through extensions (could that be the hangup with A.J. Pollock?) and maybe even through trades. And when those future dollars come home to roost — it might be a new ownership group that lives with it.

9 Responses to Double Plus: The Deferred Money Cycle Begins Again

Leave a Reply Cancel reply

Recent Posts

@ryanpmorrison

Best part of Peralta’s 108 mph fliner over the fence, IMHO: that he got that much leverage despite scooping it out… https://t.co/ivBrl76adF, Apr 08

Best part of Peralta’s 108 mph fliner over the fence, IMHO: that he got that much leverage despite scooping it out… https://t.co/ivBrl76adF, Apr 08 RT @OutfieldGrass24: If you're bored of watching Patrick Corbin get dudes out, you can check out my latest for @TheAthleticAZ. https://t.co/k1DymgY7zO, Apr 04

RT @OutfieldGrass24: If you're bored of watching Patrick Corbin get dudes out, you can check out my latest for @TheAthleticAZ. https://t.co/k1DymgY7zO, Apr 04 Of course, they may have overtaken the league lead for outs on the bases just now, also...

But in 2017, Arizona ha… https://t.co/38MBrr2D4b, Apr 04

Of course, they may have overtaken the league lead for outs on the bases just now, also...

But in 2017, Arizona ha… https://t.co/38MBrr2D4b, Apr 04 Prior to the games today, there had only been 5 steals of 3rd this season (and no CS) in the National League. The… https://t.co/gVVL84vPQ5, Apr 04

Prior to the games today, there had only been 5 steals of 3rd this season (and no CS) in the National League. The… https://t.co/gVVL84vPQ5, Apr 04 RT @OutfieldGrass24: Patrick Corbin has a WPA of .318 and it's only the fifth inning., Apr 04

RT @OutfieldGrass24: Patrick Corbin has a WPA of .318 and it's only the fifth inning., Apr 04

Powered by: Web Designers@outfieldgrass24

This Suns matchup comes at a good time for my hometown Blazers #RipCity https://t.co/fQ45wdfQUk, 28 mins ago

This Suns matchup comes at a good time for my hometown Blazers #RipCity https://t.co/fQ45wdfQUk, 28 mins ago RT @ZHBuchanan: Our @Ken_Rosenthal spoke to Ken Kendrick about trading Paul Goldschmidt.

https://t.co/O5fHRlyBxD, 7 hours ago

RT @ZHBuchanan: Our @Ken_Rosenthal spoke to Ken Kendrick about trading Paul Goldschmidt.

https://t.co/O5fHRlyBxD, 7 hours ago RT @CardsNation247: We have a good show lined up for tonight. Leading off is our friend of the show @buffa82 followed by Jeff Wiser… https://t.co/eltZC0uvyg, 7 hours ago

RT @CardsNation247: We have a good show lined up for tonight. Leading off is our friend of the show @buffa82 followed by Jeff Wiser… https://t.co/eltZC0uvyg, 7 hours ago RT @juanctoribio: To piggyback off the @ZHBuchanan and @OutfieldGrass24 that the #Rays were involved in the Paul Goldschmidt sweepsta… https://t.co/spg9x7X1L5, 7 hours ago

RT @juanctoribio: To piggyback off the @ZHBuchanan and @OutfieldGrass24 that the #Rays were involved in the Paul Goldschmidt sweepsta… https://t.co/spg9x7X1L5, 7 hours ago RT @OJCarrascoTwo: Read this from the world famous, @OutfieldGrass24 https://t.co/cHUie1I5Le, 8 hours ago

RT @OJCarrascoTwo: Read this from the world famous, @OutfieldGrass24 https://t.co/cHUie1I5Le, 8 hours ago

Powered by: Web Designers

In these last dark weeks before Spring Training, it might be interesting to see a plan revolving around a very early, rough look at rebuilding after the competition window. What rebuilding philosophies could the team take, which should they take, etc.?

Personally, I’d work to sign Pollock, Peralta, and Corbin into their FA seasons, then ship them off for prospects when they have a year left on their deals. In 2018 we’ll also be cleared to spend with consequence internationally again, which lines up nicely at the end of the contention window. If you buy into the team doing well the next three years, we probably won’t have many high draft picks, so relying solely on the draft won’t be the way to go.

If you have any further ideas, feel free to take the above and expand on it. I love the work you all do on this site!

So:

1. I love this kind of exercise.

2. This might be a largely unpopular exercise.

3. If ever we could publish this, it would be in early February, probably…

Basically, yes, and thank you. Non-zero chance this ends up a lengthy podcast topic, too.

On Greinke’s salary…yes, he’ll only receive $21M per year of salary, but doesn’t the signing bonus of $3M per year (for the next 3 years) count against the total payroll for the D’backs? So, in essence Greinke’s salary is $24M per for the next 3 years?

Larry, thanks — I think I was going off of an at-the-time report, instead of the most recent info. I’m going to correct the above.

What he receives each year is not necessarily his payroll cost. They most likely would consider the deferred amount current payroll and the deferral a liability to account for it, somewhat like a 401k except the amount would reduce his current gross income, improving the teams current cash flow without penalizing a future P&L.

What he receives each year is not necessarily his payroll cost. They most likely would consider the deferred amount current payroll and the deferral a liability to account for it, somewhat like a 401k except the amount would reduce his current gross income, improving the teams current cash flow without penalizing a future P&L.

I suspect that team accounting wise the payroll will reflect the full amounts each year, but part of that would be accrued as a future liability, conserving current cash without reducing current payroll. His salary would be the full amount, but current year earnings less because of the deferment, somewhat like a 401k except it reduces his current gross income instead of being shown as a deduction.

It will be interesting to see if the pending Tyler Clippard signing will include deferred money?

[…] Greinke’s health as he ages given the money he’s owed through his age-38 season and well beyond. Ryan will probably fire me because I didn’t suggest a starter by committee approach, but if […]